Japan Retinal Surgery Device Market Size and Forecast (2025–2033)

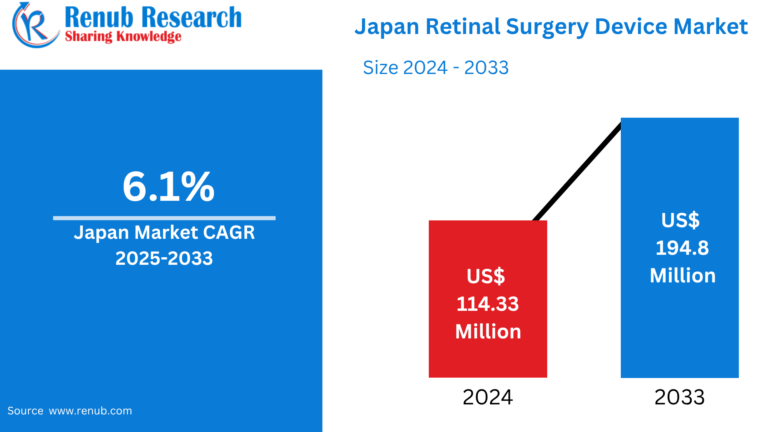

According to Renub Research Japan retinal surgery device market is projected to grow steadily over the forecast period, supported by demographic shifts and continuous innovation in ophthalmic care. The market is expected to expand from US$ 114.33 million in 2024 to US$ 194.8 million by 2033, registering a compound annual growth rate (CAGR) of 6.1% from 2025 to 2033. Key growth drivers include Japan’s rapidly aging population, rising prevalence of diabetic retinopathy and other retinal disorders, advancements in surgical and imaging technologies, and a strong healthcare infrastructure backed by supportive government policies.

Retinal surgery devices play a critical role in diagnosing and treating complex retinal conditions that can otherwise lead to irreversible vision loss. As awareness of early diagnosis and timely intervention increases, demand for advanced retinal surgical solutions is expected to remain strong across hospitals and specialized eye clinics in Japan.

Japan Retinal Surgery Device Market Overview

The Japanese retinal surgery device market is witnessing consistent expansion due to the growing burden of age-related and lifestyle-associated eye diseases. Conditions such as diabetic retinopathy, age-related macular degeneration, retinal detachment, and macular holes are becoming increasingly common as life expectancy rises and chronic diseases such as diabetes become more prevalent. These conditions often require surgical intervention, creating sustained demand for specialized retinal surgery devices.

Japan benefits from one of the most advanced healthcare systems globally, characterized by high standards of clinical care, modern hospital infrastructure, and widespread access to specialized medical services. Ophthalmology, in particular, is a well-developed specialty, with surgeons increasingly adopting advanced microsurgical instruments, high-precision lasers, and sophisticated imaging technologies to improve surgical outcomes. The integration of innovation with clinical expertise positions Japan as a key market for retinal surgery devices.

Request a free sample copy of the report:https://www.renub.com/request-sample-page.php?gturl=japan-retinal-surgery-device-market-p.php

Key Factors Driving the Japan Retinal Surgery Device Market Growth

Rising Aging Population

Japan has one of the world’s most rapidly aging populations, making demographic change a primary driver of the retinal surgery device market. As individuals age, the risk of retinal diseases such as macular degeneration, retinal detachment, and diabetic retinopathy increases significantly. These conditions often require surgical management to preserve vision and maintain quality of life.

Elderly patients are also more likely to seek specialized medical care and undergo advanced surgical procedures, supported by Japan’s universal healthcare coverage. This demographic trend has led to an increase in the volume of retinal surgeries performed annually, prompting healthcare institutions to invest in advanced surgical equipment. Consequently, the aging population remains a fundamental factor sustaining long-term market growth.

Strong Healthcare Infrastructure and Accessibility

Japan’s robust healthcare infrastructure plays a crucial role in supporting the adoption of retinal surgery devices. The country has an extensive network of hospitals, academic medical centers, and specialized eye clinics equipped with advanced diagnostic and surgical capabilities. Universal health insurance coverage ensures that a large portion of the population can access high-quality ophthalmic care, including complex retinal procedures.

Government initiatives emphasizing preventive healthcare and early disease detection have increased routine eye screenings, leading to earlier diagnosis of retinal disorders. Early detection often results in timely surgical intervention, further driving demand for retinal surgery devices. The combination of accessibility, affordability, and clinical excellence makes Japan a favorable market for advanced ophthalmic technologies.

Growing Technological Advancements in Retinal Surgery

Technological innovation is a major contributor to the growth of the retinal surgery device market in Japan. Advancements in vitrectomy systems, high-resolution retinal imaging, laser technologies, and minimally invasive surgical instruments have significantly improved procedural precision and patient outcomes.

Modern vitrectomy machines offer higher cutting speeds, improved fluidics, and enhanced control, enabling safer and more efficient surgeries. Real-time imaging systems and AI-assisted diagnostic tools allow surgeons to visualize retinal structures with greater accuracy, particularly in complex cases. Robotic-assisted and minimally invasive technologies reduce surgical trauma and recovery time, increasing patient confidence in surgical treatments. Continuous research and development by domestic and international manufacturers ensure a steady pipeline of innovation, reinforcing Japan’s leadership in ophthalmic technology adoption.

Challenges in the Japan Retinal Surgery Device Market

High Cost of Advanced Surgical Devices

Despite strong demand, the high cost of advanced retinal surgery devices remains a significant challenge. Cutting-edge equipment such as robotic-assisted systems, precision lasers, and advanced imaging platforms require substantial capital investment. Smaller hospitals, regional clinics, and rural healthcare facilities may struggle to afford these technologies, resulting in uneven adoption across the country.

In addition to acquisition costs, expenses related to maintenance, software upgrades, staff training, and system integration further increase the financial burden. These factors can slow the replacement cycle of existing equipment and limit the adoption of the latest innovations, particularly outside major urban centers.

Shortage of Specialized Ophthalmic Surgeons

Another major challenge facing the Japanese retinal surgery device market is the shortage of highly specialized retinal surgeons. Retinal surgeries demand exceptional skill, precision, and extensive training, making the specialty both time-intensive and demanding. As a result, the number of new specialists entering the field has not kept pace with rising demand.

This shortage is more pronounced in rural and semi-urban regions, where access to advanced retinal care is limited. Even when healthcare facilities invest in state-of-the-art surgical devices, the lack of trained professionals can restrict their effective utilization. Bridging this gap through enhanced training programs and surgical education is essential for maximizing market potential.

Japan Retinal Surgery Device Market Segmentation

By Product

The market is segmented into vitrectomy machines, vitrectomy packs, surgical instruments, microscopic illumination equipment, retinal laser equipment, and others. Vitrectomy machines hold a significant share due to their central role in retinal procedures, while retinal laser equipment continues to gain traction for minimally invasive treatments and precision therapy.

By Application

Based on application, the market includes diabetic retinopathy, retinal detachment, epiretinal membrane, macular hole, and other retinal disorders. Diabetic retinopathy represents a major segment, driven by the rising prevalence of diabetes in Japan. Retinal detachment and macular hole surgeries also contribute significantly to overall device demand.

By End User

End users of retinal surgery devices include hospitals, eye clinics, and other healthcare facilities. Hospitals dominate the market due to their advanced infrastructure and ability to perform complex surgical procedures. However, specialized eye clinics are increasingly adopting advanced devices, supported by outpatient surgical trends and patient preference for specialized care.

Competitive Landscape and Key Companies

The Japan retinal surgery device market is moderately competitive, with both global and regional players actively investing in innovation and strategic partnerships. Leading companies operating in the market include Topcon Corporation, Alcon AG, Carl Zeiss, Bausch Health Companies Inc., Iridex Corporation, Escalon Medical, Quantel Medical, and Rhein Medical, Inc..

These companies compete through technological innovation, product differentiation, training programs for surgeons, and expansion of distribution networks across Japan.

Conclusion

The Japan retinal surgery device market is set for steady growth through 2033, driven by demographic trends, rising disease prevalence, strong healthcare infrastructure, and continuous technological advancements. While challenges such as high equipment costs and a shortage of specialized surgeons persist, supportive government policies and ongoing innovation are expected to mitigate these constraints over time. As Japan continues to prioritize early diagnosis and high-quality ophthalmic care, retinal surgery devices will remain a critical component of the country’s advanced healthcare ecosystem.