Australia Cosmetics Market Analysis

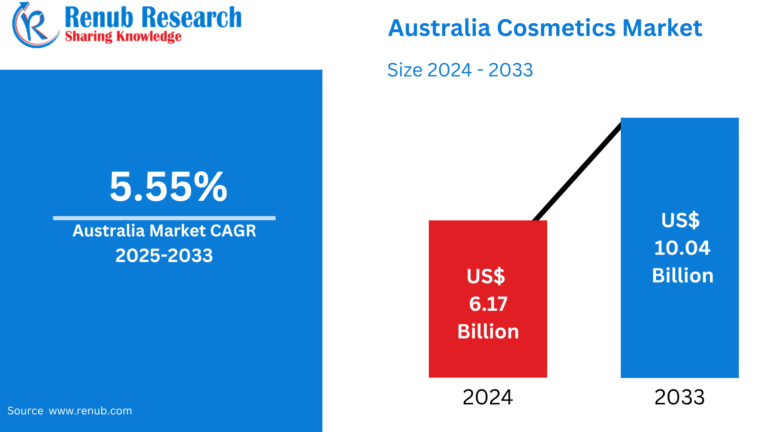

According to Renub Research Australia cosmetics market is demonstrating steady growth, supported by evolving consumer preferences, rising disposable incomes, and strong digital influence. Valued at US$ 6.17 billion in 2024, the market is forecast to reach US$ 10.04 billion by 2033, expanding at a CAGR of 5.55% from 2025 to 2033.

This growth is largely attributed to increasing demand for organic and natural cosmetics, heightened awareness of skincare and wellness, and a growing inclination toward premium and personalized beauty products. In addition, the rapid expansion of e-commerce platforms has significantly enhanced product accessibility and variety, enabling both domestic and international brands to reach Australian consumers more effectively.

Australia Cosmetics Market Overview

Cosmetics encompass a wide range of products designed to cleanse, protect, enhance, and beautify the skin, hair, and nails. In modern society, cosmetics extend beyond aesthetics to represent personal hygiene, self-expression, confidence, and lifestyle choices. From skincare and makeup to fragrances and haircare, cosmetics combine scientific research with creativity to meet constantly evolving beauty standards.

In Australia, the cosmetics market reflects strong consumer awareness around ingredient safety, ethical sourcing, and sustainability. Vegan, organic, and cruelty-free products are gaining significant traction as consumers increasingly align their purchasing decisions with environmental and ethical values. Cosmetics are now viewed not only as beauty enhancers but also as wellness-oriented products that support skin health and long-term care. The market’s ability to adapt to trends, cultural diversity, and technological innovation continues to drive its expansion across the country.

Request a free sample copy of the report:https://www.renub.com/request-sample-page.php?gturl=australia-cosmetics-market-p.php

Key Dynamics Shaping the Australian Cosmetics Industry

The Australian cosmetics industry is influenced by a combination of social, economic, and technological factors. Consumers are becoming more educated about skincare science, leading to higher demand for evidence-based and dermatologist-recommended products. Ethical considerations such as sustainability, animal welfare, and clean formulations are no longer niche concerns but mainstream expectations.

Social media platforms, beauty influencers, and digital marketing campaigns play a crucial role in shaping consumer perceptions and accelerating trend adoption. Meanwhile, Australia’s multicultural population is driving demand for inclusive beauty products that cater to diverse skin tones, hair types, and cultural preferences. Together, these factors are reshaping product development, branding strategies, and retail models across the cosmetics landscape.

Growth Drivers for the Australia Cosmetics Market

Growing Impact of Clean Beauty and Sustainability Trends

The clean beauty and sustainability movement is one of the most powerful drivers of growth in the Australian cosmetics market. Consumers are increasingly prioritizing products that are ethically sourced, environmentally friendly, and transparent in their ingredient composition. Brands that demonstrate commitment to sustainability through recyclable or biodegradable packaging, cruelty-free testing, and non-toxic formulations are gaining a strong competitive advantage.

Australia has witnessed the rise of local independent and organic beauty brands that emphasize natural ingredients and minimalistic formulations. Consumers frequently research brand values, supply chains, and certifications before making purchasing decisions. Retailers are responding by allocating greater shelf space to sustainable cosmetics and introducing digital filters that allow shoppers to identify clean and ethical products easily. Sustainability has become a long-term consumer expectation rather than a temporary trend, influencing innovation, marketing, and retail strategies across the market.

Innovation and Technological Advancements

Innovation is a central pillar of growth in the Australian cosmetics industry. Consumers are increasingly seeking high-performance, science-backed products that address specific skin concerns such as aging, sensitivity, acne, and barrier repair. Brands are investing in biotechnology, advanced dermatological research, and artificial intelligence–driven personalization tools to meet these expectations.

Technological advancements in formulation, such as active ingredient encapsulation and microbiome-friendly skincare, are enhancing product efficacy and consumer trust. Personalized skincare solutions based on skin analysis and data-driven recommendations are becoming more common. This shift toward technology-enabled, results-oriented beauty reflects a broader transformation of the market from traditional cosmetics to advanced skincare and wellness solutions.

Growth of E-commerce and Digital Channels

The rapid expansion of e-commerce and digital platforms is significantly accelerating growth in the Australian cosmetics market. Online shopping offers consumers convenience, broader product selection, and access to global and niche beauty brands that may not be available in physical stores.

Digital tools such as virtual try-ons, AI-powered skin assessments, influencer content, and interactive tutorials enhance consumer engagement and purchasing confidence. Brands are increasingly adopting omnichannel strategies that integrate online and offline experiences, ensuring seamless customer journeys. The continued evolution of digital retail is reshaping how Australians discover, evaluate, and purchase cosmetic products, making it a key driver of market expansion.

Challenges in the Australia Cosmetics Market

Intense Competition

The Australian cosmetics market is highly competitive, with a large number of domestic and international brands competing for consumer attention. This crowded landscape makes differentiation increasingly challenging. Brands must continuously innovate, invest in branding, and communicate unique value propositions to stand out.

Intense competition also places pressure on pricing, marketing budgets, and product development cycles. Companies are required to balance premium positioning with affordability while maintaining consistent quality. As a result, sustaining long-term customer loyalty and market share has become more complex in this highly dynamic environment.

Price Sensitivity Among Consumers

Despite growing interest in premium cosmetics, price sensitivity remains a notable challenge in the Australian market. Rising living costs have made consumers more cautious with discretionary spending, including beauty and personal care products.

Consumers increasingly seek value-for-money solutions, expecting high performance and ethical standards without significant price premiums. This trend forces brands to optimize production costs, streamline supply chains, and adopt flexible pricing strategies. Successfully balancing quality, sustainability, and affordability is critical for maintaining competitiveness and profitability.

Recent Developments in the Australia Cosmetics Industry

Recent years have seen strategic expansions and partnerships that highlight the market’s dynamism. International brands are entering Australia through collaborations with local distributors and medical aesthetics professionals, reflecting strong confidence in market potential. At the same time, global beauty retailers are expanding their physical presence with experiential stores that integrate technology, live events, and exclusive product offerings.

These developments are increasing consumer engagement, intensifying competition, and reinforcing Australia’s position as a key market for premium and innovative cosmetics in the Asia-Pacific region.

Australia Cosmetics Market Segmentation by Product Type

The market is segmented into skin and sun care products, hair care products, deodorants and fragrances, makeup and color cosmetics, and other cosmetic products. Skin and sun care products hold a significant share due to Australia’s climate, high UV exposure, and strong consumer focus on skincare health and protection.

Australia Cosmetics Market Segmentation by Gender

Based on gender, the market is divided into men, women, and unisex segments. While women continue to represent the largest consumer group, demand for men’s grooming products and unisex cosmetics is growing rapidly, driven by changing social norms and increased self-care awareness.

Australia Cosmetics Market Segmentation by Distribution Channel

Distribution channels include supermarkets and hypermarkets, specialty stores, pharmacies, online sales, and other retail formats. Online sales represent the fastest-growing channel, supported by digital innovation, convenience, and expanding brand presence across e-commerce platforms.

Competitive Landscape of the Australia Cosmetics Market

The Australian cosmetics market is moderately fragmented, with both global corporations and regional players competing across product categories. Leading companies are focusing on innovation, sustainability, premiumization, and digital engagement to strengthen their market positions. Key players operating in the market include:

- Coty Inc.

- Procter & Gamble

- Colgate-Palmolive Company

- Johnson & Johnson Services Inc.

- Revlon, Inc.

- Beiersdorf Group

- Kao Corporation

- LVMH

- Mary Kay Inc.

These companies are investing in product innovation, sustainable practices, digital marketing, and strategic partnerships to maintain competitiveness in the evolving Australian beauty market.

Conclusion

The Australia cosmetics market is set to experience steady growth through 2033, driven by clean beauty trends, technological innovation, digital retail expansion, and rising consumer awareness. While challenges such as intense competition and price sensitivity persist, brands that successfully balance sustainability, performance, and affordability are well positioned to thrive. As cosmetics increasingly intersect with wellness, technology, and ethical consumption, the Australian market is expected to remain a dynamic and attractive destination for both established players and emerging brands.