Automotive Paint Market Companies Analysis 2025–2033

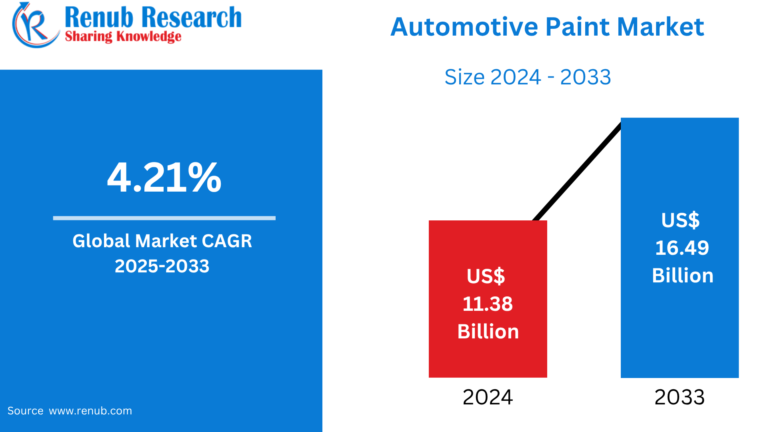

According to Renub Research global automotive paint market is witnessing steady expansion, valued at approximately US$ 11.38 Billion in 2024 and projected to reach US$ 16.49 Billion by 2033, registering a CAGR of 4.21% from 2025 to 2033. Automotive paints are essential coatings applied to vehicles not only for aesthetic enhancement but also to protect against corrosion, UV radiation, chemicals, and environmental wear. Typically structured in primer, basecoat, and clearcoat layers, these coatings ensure adhesion, durability, gloss, and surface resilience. Advancements in waterborne coatings, powder coatings, low-VOC solutions, nanocoatings, eco-friendly materials, UV-curable paints, and customizable finishes are strengthening product performance while supporting global sustainability regulations.

Market Drivers Strengthening Company Growth

Rising consumer interest in vehicle aesthetics and customization, increasing vehicle production, and heightened emphasis on corrosion protection are the primary market catalysts. The rapid expansion of electric vehicles is opening opportunities for lightweight and specialty coatings tailored for thermal management, insulation, and enhanced durability. Automotive aftermarket repainting, refurbishment services, and collision repair demand are also significantly contributing to market growth. Eco-friendly waterborne and low-emission coatings continue to gain adoption as governments impose stringent emission and environmental standards.

Strong growth in Asia-Pacific, driven by urbanization, higher disposable incomes, and increasing automotive ownership, remains a critical success factor for leading paint manufacturers. Meanwhile, North America and Europe are sustaining growth through technological innovation, sustainability leadership, and partnerships with leading automobile OEMs.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=automotive-paint-market-competitive-landscape-p.php

Leading Companies in the Automotive Paint Industry

Axalta Coating Systems Ltd.

Founded in 2013 and headquartered in the United States, Axalta is a leading global manufacturer of high-performance liquid and powder coating systems. Serving automotive OEMs, commercial vehicle manufacturers, industrial markets, and body shops, Axalta’s brands such as Cromax, Standox, Syrox, Spies Hecker, and Raptor are widely recognized for reliability, color innovation, and finishing quality. Its strong sales force, extensive technical support network, and global distribution infrastructure support its robust international market presence.

The Sherwin-Williams Company

Established in 1866 and headquartered in Cleveland, Sherwin-Williams is one of the world’s most influential paint and coatings companies. The company offers automotive coatings alongside architectural paints, varnishes, stains, industrial coatings, and specialty finishes under well-known brands including Krylon, Minwax, Dutch Boy, and Thompson’s Water Seal. With operations extending across North America, Europe, Asia-Pacific, and Latin America, Sherwin-Williams benefits from a comprehensive multi-channel retail and industrial distribution network.

Kansai Paints Co. Ltd. / Kansai Nerolac

Kansai Nerolac, headquartered in Mumbai, India, is one of Asia’s leading automotive and industrial paint producers. Serving OEMs, industrial clients, decorative segments, and aftermarket customers, the company offers advanced coatings tailored for varied climatic conditions and surface durability needs. Its extensive manufacturing footprint across India and operations spanning Asia-Pacific and Africa enhance production capability and regional responsiveness.

Solvay S.A.

Headquartered in Belgium, Solvay is a global chemical company providing essential materials and advanced chemical solutions for automotive coatings manufacturing. Its diverse product portfolio includes polymers, rare earth derivatives, lithium chemicals, additives, and performance materials that enhance coating durability, chemical resistance, adhesion, and environmental performance. Solvay’s wide industrial presence across sectors strengthens cross-innovation potential for automotive coatings formulations.

Cabot Corporation

Cabot Corporation, headquartered in the United States, is a prominent specialty chemicals producer supplying advanced materials for automotive paint systems. Key products include carbon black, conductive additives, fumed metal oxides, aerogels, and inkjet colorants, which enhance coating performance, conductivity, reinforcement, and finish aesthetics. Its global manufacturing and R&D networks allow the company to support automotive paint manufacturers with high-performance innovation.

SWOT Insights of Key Automotive Paint Market Players

DuPont de Nemours Inc. – Strategic Strength & Opportunity

Strength – Advanced Materials Innovation:

DuPont’s leadership in polymer science and chemical technologies enables development of high-durability automotive coatings offering superior UV stability, scratch resistance, heat tolerance, and corrosion protection. Strong OEM partnerships allow tailored coating solutions aligned with evolving automotive design and EV-specific requirements.

Opportunity – Sustainable Coatings Expansion:

With tightening VOC restrictions and increasing focus on eco-friendly manufacturing, DuPont is well-positioned to expand its portfolio of waterborne, bio-based, and low-VOC coatings, aligning with automakers’ sustainability commitments and regulatory compliance needs.

Asian Paints Ltd. – Strength & Opportunity

Strength – Robust Brand and Distribution Power:

Asian Paints benefits from an exceptionally strong distribution ecosystem across India and emerging markets, extensive aftermarket reach, and responsive customer service capabilities, enabling strong penetration across OEM and refinishing segments.

Opportunity – Growth in OEM Partnerships:

Rapid automotive expansion in Asia creates opportunities for Asian Paints to deepen OEM collaborations, enhance premium coating solutions, and align product development with EV and sustainability requirements to gain higher-value contracts.

Sustainability Focus Among Leading Automotive Paint Companies

Nippon Paint Holdings Co., Ltd.

Nippon Paint is strongly advancing toward net-zero emission commitments, renewable energy integration, resource efficiency, solvent recovery, VOC reduction, and water recycling initiatives. It continues to enhance sustainability governance through TCFD-based strategies and Responsible Care policies, although Scope 3 emission reduction remains an ongoing challenge.

PPG Industries, Inc.

PPG has set ambitious sustainability targets validated by SBTi, including a 50% reduction in Scope 1 and 2 emissions by 2030 and a 30% reduction in Scope 3 emissions. Progress includes expanding sustainably advantaged product sales, waste reduction initiatives, increased supplier sustainability evaluation, and enhanced water efficiency—positioning PPG as a leader in responsible coatings manufacturing.

Recent Developments in the Automotive Paint Industry

• June 2025 – AkzoNobel launched its Productivity Drive 2025 European roadshow featuring advanced waterborne basecoats Sikkens Autowave Optima and Lesonal Ultimate Basecoat WB, focusing on productivity and sustainability.

• September 2024 – BASF Coatings introduced ChemCycling® clearcoat using recycled tire materials, supporting circular economy objectives.

• February 2022 – AkzoNobel & McLaren Racing extended their long-term partnership to enhance innovation, sustainability, and product performance initiatives.

Market Outlook, Forecast, and Company Coverage

The outlook for the automotive paint market remains highly positive as companies continue investing in:

• Advanced eco-friendly coating technologies

• EV-compatible materials and lightweight surface solutions

• Customization-driven premium finishing innovations

• Stronger OEM and aftermarket partnerships

The comprehensive Automotive Paint Market & Forecast coverage includes historical trends, forecast analysis, market share assessment, and detailed company analysis. Key companies covered include:

Akzo Nobel, Axalta, Sherwin-Williams, Kansai Paints, DuPont, Solvay, Cabot Corporation, Covestro, BASF SE, Nippon Paint, Valspar, Asian Paints, Clariant, RPM International, and others.