Global Spices Market Analysis

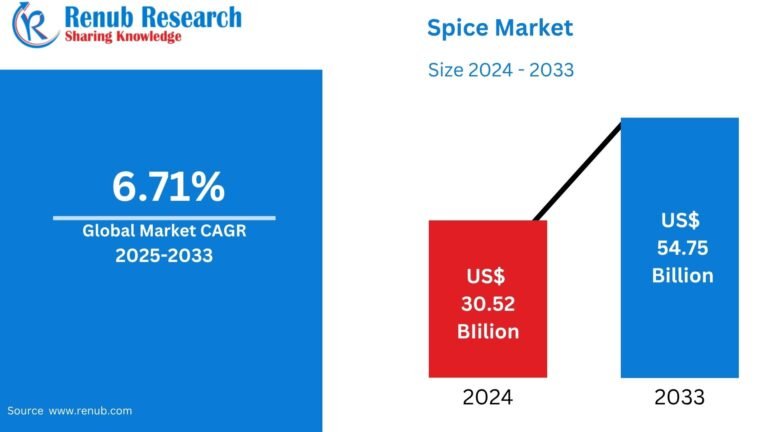

According to Renub Research Global Spices Market was valued at US$ 30.52 billion in 2024 and is projected to reach approximately US$ 54.75 billion by 2033, expanding at a compound annual growth rate (CAGR) of 6.71% during 2025–2033. This steady growth reflects rising global demand for ethnic cuisines, increased awareness of the health benefits of spices, and their expanding use across food processing, nutraceuticals, and pharmaceutical applications.

Spices are no longer limited to traditional cooking applications. They have evolved into functional ingredients supporting clean-label foods, immunity-boosting products, and wellness formulations. The growing preference for natural flavoring agents over artificial additives is reshaping the global food industry and strengthening long-term market prospects.

Global Spices Market Overview

Spices are dried plant-derived substances used to enhance flavor, aroma, color, and shelf life of food. Commonly used spices include turmeric, cumin, coriander, black pepper, ginger, cinnamon, cloves, cardamom, and chili. These are sourced from different plant parts such as seeds, roots, bark, fruits, and flowers.

Historically, spices have played a vital role in global trade, medicine, and cultural traditions. Today, their importance has expanded beyond culinary usage into healthcare, cosmetics, preservatives, and functional foods due to their antioxidant, antimicrobial, and anti-inflammatory properties.

Globalization, food tourism, and exposure to international cuisines have fueled demand for both staple and exotic spices. Additionally, advancements in packaging, processing, and supply chain logistics have made spices more accessible across developed and emerging markets alike.

Request a free sample copy of the report:https://www.renub.com/request-sample-page.php?gturl=global-spices-market-p.php

Key Growth Drivers of the Global Spices Market

Rising Health Awareness and Demand for Natural Ingredients

Consumers worldwide are shifting away from synthetic additives toward natural and plant-based ingredients. Spices such as turmeric, ginger, garlic, cinnamon, and black pepper are widely recognized for their immune-enhancing, digestive, and anti-inflammatory benefits.

This shift has driven strong demand from:

- Health-conscious households

- Functional food manufacturers

- Nutraceutical and pharmaceutical companies

The growing popularity of organic foods and clean-label products further supports spice consumption. As preventive healthcare and immunity-focused diets gain momentum, naturally sourced spices are expected to remain in high demand throughout the forecast period.

Globalization of Food Culture and Ethnic Cuisines

The expansion of international travel, migration, food media, and restaurant chains has accelerated the adoption of ethnic cuisines worldwide. Asian, Middle Eastern, Latin American, and African dishes rely heavily on spices, significantly increasing global demand.

Food manufacturers are incorporating diverse spice blends into:

- Ready-to-eat meals

- Frozen foods

- Snack products

- Restaurant menus

This cultural integration is no longer limited to metropolitan regions and continues to spread into suburban and rural markets, creating consistent consumption growth.

Expansion of E-commerce and Branded Packaged Spices

Digital retail platforms have transformed how spices are marketed and sold. Consumers now have easy access to:

- Exotic and rare spices

- Organic and fair-trade varieties

- Premium blended seasonings

Branded packaged spices emphasizing quality, traceability, hygiene, and labeling transparency are gaining trust among urban consumers. E-commerce also allows small and mid-sized producers to reach international markets directly, strengthening market inclusivity and competitiveness.

Challenges in the Global Spices Market

Raw Material Price Volatility and Supply Chain Risks

Spice production is highly dependent on climatic conditions and agricultural output. Factors such as:

- Climate change

- Pest infestations

- Extreme weather events

can significantly impact crop yields of pepper, cardamom, saffron, and chili. Price volatility affects profitability for processors and traders, while logistical constraints in developing regions can disrupt timely delivery and quality consistency.

Adulteration and Quality Concerns

Adulteration remains a major issue in the spice industry, particularly in unregulated markets. Practices such as mixing fillers, artificial dyes, or expired stock damage consumer trust and restrict export opportunities.

As global buyers increasingly demand certifications, traceability, and food safety compliance, companies must invest in quality control systems, laboratory testing, and digital traceability solutions—posing cost challenges, especially for small producers.

Segment Analysis of the Global Spices Market

Pepper Spices Market

Black pepper is one of the most widely traded spices globally due to its strong flavor profile and digestive benefits. It is extensively used in household cooking, processed foods, sauces, and meat products. Major producers include India, Vietnam, and Indonesia. Growing interest in organic pepper and sustainable sourcing supports premium market growth.

Ginger Spices Market

Ginger holds a strong position due to its dual culinary and medicinal value. Widely used in teas, health drinks, pharmaceuticals, and global cuisines, ginger demand surged during recent health crises. The ongoing popularity of herbal remedies and functional foods ensures continued expansion of this segment.

Chilies Spices Market

Chilies are essential to cuisines worldwide, offering a wide range of heat levels and flavor profiles. Products include fresh chilies, dried pods, powders, and flakes. Rising global preference for spicy foods, especially among younger consumers, continues to drive this segment. Capsaicin-based health products also enhance market value.

Meat and Poultry Spices Market

Spice blends formulated for meat and poultry products—such as barbecue rubs, marinades, and regional masalas—are experiencing strong growth. Rising protein consumption, ready-to-cook meals, and grilling culture in North America and Europe are key contributors.

Powdered vs. Whole Spices

Powdered spices dominate retail shelves due to convenience and long shelf life, while whole spices are gaining popularity for their aroma, purity perception, and traditional usage. Restaurants and bulk buyers continue to favor whole spices for custom blending and freshness.

Regional Insights

United States Spices Market

The U.S. spices market is driven by multicultural demographics, rising interest in global cuisines, and health-focused consumption. Organic, non-GMO, and specialty spice blends are in high demand. Leading companies continue to innovate with reduced-sodium seasonings and functional spice blends to meet evolving consumer preferences.

France Spices Market

France’s spice market is shaped by gourmet culinary traditions and premium imports. Demand is growing for saffron, peppercorns, herbs, and exotic spices. Ethical sourcing and organic certification are becoming increasingly important among French consumers.

India Spices Market

India is the world’s largest producer and consumer of spices, deeply rooted in culinary, medicinal, and cultural traditions. Strong domestic demand and expanding exports position India as a global hub. Government initiatives, improved processing technologies, and sustainability programs are enhancing global competitiveness.

Saudi Arabia Spices Market

Saudi Arabia relies heavily on spice imports and exhibits strong demand driven by traditional cuisine, urbanization, and a growing expatriate population. Ready-mix spice blends and premium seasonings are increasingly popular. Government initiatives to diversify agriculture and food processing further support market growth.

Global Spices Market Segmentation

By Product Type

- Pure Spices (Chilies, Ginger, Cumin, Pepper, Turmeric, Coriander, Others)

- Blended Spices

By Application

- Meat and Poultry Products

- Bakery and Confectionery

- Frozen Foods

- Snacks and Convenience Foods

- Others

By Form

- Powder

- Whole

- Crushed

- Chopped

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Competitive Landscape

The global spices market is moderately fragmented, with multinational corporations and regional players competing on quality, sourcing, innovation, and branding. Key players include:

- McCormick & Company

- Kerry Group plc

- Ajinomoto Co. Inc.

- Olam International

- EVEREST Food Products Pvt. Ltd.

Companies are focusing on organic certification, clean labeling, sustainable sourcing, and innovative blends to gain competitive advantage.

Conclusion

The Global Spices Market is positioned for sustained growth through 2033, supported by evolving food preferences, health-driven consumption, and expanding global trade. While challenges such as adulteration and raw material volatility persist, innovation, regulation, and digital transformation are strengthening market resilience. Spices will continue to play a critical role not only in global cuisines but also in wellness, functional foods, and pharmaceutical applications worldwide.