Japan Telecom Market Overview

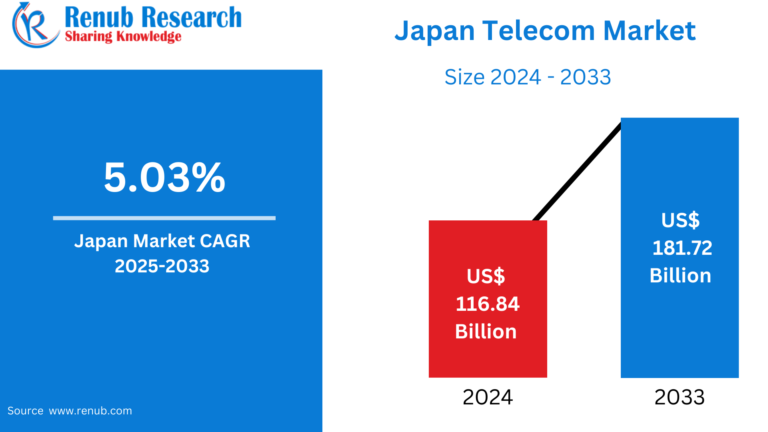

According to Renub Research Japan Telecom Market is on a strong upward trajectory, projected to grow from US$ 116.84 billion in 2024 to US$ 181.72 billion by 2033, recording a CAGR of 5.03% during 2025–2033. Japan remains one of the world’s most technologically advanced telecommunications environments, characterized by widespread connectivity, cutting-edge innovation, and rapid digital transformation. High-speed internet adoption, accelerating 5G deployment, rising demand for data services, and government-led smart city initiatives are fueling the market’s expansion.

Telecommunication services form the backbone of Japan’s digital economy, supporting personal communication, enterprise operations, government activities, entertainment, and smart infrastructure. With one of the world’s highest mobile penetration rates, Japan continues to invest heavily in network modernization, fiber infrastructure, and emerging technologies such as IoT, AI integration, cloud connectivity, and advanced broadcasting. These developments ensure consistent growth, enhanced user experience, and strengthened national competitiveness in global technology markets.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=japan-telecom-market-p.php

Importance of Telecom in Japan’s Digital Ecosystem

Telecommunications play a vital role in Japan’s daily life and economic functioning. Mobile communication, messaging platforms, and broadband connectivity enable personal interactions and social engagement nationwide. For corporations, telecom services support cloud computing, remote collaboration, enterprise communication, cybersecurity, data transmission, and AI-powered business functions. Critical industries including finance, healthcare, manufacturing, logistics, media, and entertainment rely on resilient telecom infrastructure to sustain productivity and innovation.

Telecom is also central to Japan’s smart city transformation, enabling intelligent transportation systems, public safety communication, environmental monitoring, and infrastructure automation. Supported by government strategies such as Society 5.0, Japan’s telecom sector continues to advance technological progress and foster economic development.

Key Growth Drivers in the Japan Telecom Market

Aggressive 5G Rollout Strengthening Connectivity

Japan’s telecom operators—including NTT Docomo, KDDI, SoftBank, and Rakuten Mobile—are driving rapid nationwide 5G expansion. 5G delivers ultra-fast speeds, minimal latency, and robust connectivity required for industrial automation, autonomous vehicles, immersive media, and IoT-driven smart environments. Supportive government policies and investments accelerate deployment, ensuring Japan remains at the forefront of global telecom innovation. Enhanced user experiences, cloud gaming advancements, enterprise mobility solutions, and smart infrastructure applications reinforce 5G as a cornerstone of Japan’s telecom future.

Growing Demand for High-Speed Data Services

Japan’s digitally advanced society continues to drive strong demand for high-speed mobile and fixed broadband data services. Consumers increasingly rely on mobile internet for video streaming, e-commerce, gaming, and social media, while enterprises accelerate adoption of cloud computing, AI solutions, big data platforms, and IoT ecosystems. Post-pandemic digital transformation has significantly boosted bandwidth usage, further supported by Japan’s world-leading fiber-optic penetration and network stability. Expanding broadband capacity ensures reliable connectivity for remote working, smart devices, ultra-HD streaming, and enterprise applications.

Government Support and Smart City Initiatives

Government initiatives such as Society 5.0, nationwide digital inclusion programs, rural broadband expansion, and smart city investments are critical market growth catalysts. Cities like Tokyo, Osaka, Saitama, and others continue integrating telecom technologies to enhance transportation, healthcare, urban management, and citizen services. Public–private collaboration encourages infrastructure expansion, technological adoption, and innovation in fields such as telemedicine, autonomous mobility, logistics automation, and e-governance, reinforcing telecom as a fundamental pillar of Japan’s digital progress.

Major Challenges Affecting the Japan Telecom Market

Intense Market Competition and Pricing Pressure

Japan’s telecom market is highly competitive, with leading operators engaging in aggressive pricing strategies to retain and attract customers. Frequent price reductions and competitive data plans lead to shrinking Average Revenue Per User (ARPU), pressuring operator profitability. While this benefits consumers, it challenges telecom companies to balance affordability with massive capital investments required for 5G and future 6G infrastructure. Sustaining profitability amid intense competition remains a critical industry challenge.

High Infrastructure Investment Requirements

Telecom infrastructure deployment demands substantial capital expenditure, particularly for national 5G rollout, fiber expansion, network upgrades, and research for future technologies. Urban density requires extensive small-cell deployment, while ensuring connectivity in rural and remote areas adds financial burdens. As operators invest heavily in both maintenance and innovation, managing costs while maintaining service quality is essential to long-term market sustainability.

Segment Insights in the Japan Telecom Market

Japan Wireless Voice Market

Wireless voice services remain relevant but are gradually declining as data-centric communication platforms gain popularity. Operators are integrating voice services within bundled plans and enhancing quality through VoLTE and 5G voice calling technologies. However, the shift toward messaging apps and internet-based communication restricts voice revenue growth, pushing operators to emphasize value-added and data-driven services.

Japan OTT and Pay-TV Market

OTT platforms and Pay-TV services continue gaining momentum as consumers increasingly prefer on-demand, personalized entertainment experiences. Streaming platforms such as Netflix, Amazon Prime Video, U-NEXT, AbemaTV, and domestic providers thrive due to widespread broadband access and strong digital consumption trends. Pay-TV remains essential for sports and local content, while bundled telecom-OTT packages enhance customer retention and subscription value.

Regional Market Insights

Tokyo Telecom Market

Tokyo represents the largest and most technologically advanced telecom hub in Japan. High population density, strong enterprise presence, and advanced digital initiatives drive massive demand for ultra-fast connectivity, smart city applications, IoT services, and enterprise communication solutions. Tokyo leads in 5G adoption and continues to set benchmarks for telecom modernization.

Saitama Telecom Market

Part of the Greater Tokyo metropolitan region, Saitama demonstrates strong telecom expansion driven by residential demand, industrial requirements, increasing digital consumption, and growing smart home penetration. Rapid 5G rollout and broadband enhancements support both urban and suburban connectivity needs.

Fukuoka Telecom Market

Fukuoka is emerging as a vibrant technology and business hub, fueling increasing demand for high-speed broadband, 5G connectivity, cloud communication, and smart infrastructure services. The city’s innovation-driven environment and startup ecosystem accelerate digital transformation and telecom infrastructure investments.

Shizuoka Telecom Market

Shizuoka exhibits steady telecom growth supported by urbanization, manufacturing activity, and rising dependence on mobile and fixed broadband. Expanding fiber networks, increasing mobile usage, and industrial IoT demand contribute to regional telecom development.

Market Segmentation Overview

The Japan Telecom Market is segmented by services, including voice services (wired and wireless), data and messaging services, and OTT & Pay-TV services, and by major cities such as Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, and Shizuoka.

Competitive Landscape and Key Market Players

Japan’s telecom industry is dominated by leading operators and technology providers including Nippon Telegraph and Telephone Corporation (NTT), KDDI Corporation, SoftBank Group Corp., Rakuten Mobile, Internet Initiative Japan Inc., JSAT Corporation, and TOKAI Communications Corporation. These companies continue to invest in network expansion, 5G innovation, digital platforms, cloud solutions, cybersecurity, and advanced connectivity services to strengthen market leadership.

Future Outlook of the Japan Telecom Market

The outlook for the Japan Telecom Market remains highly positive. Continued 5G expansion, advancements toward 6G research, integration of IoT ecosystems, smart city development, and rising enterprise digitalization will reinforce sustained industry growth. As Japan continues to embrace digital transformation, telecom services will remain essential to national innovation, economic strength, and global technological leadership through 2033 and beyond.