Earning a paycheck is a significant motivator for many employees, and knowing exactly what to expect in your earnings can provide both financial clarity and peace of mind. Starbucks employees often juggle variable hours, different pay rates, and tips, which can make it challenging to estimate earnings accurately. The Starbucks paycheck calculator emerges as a powerful tool in this scenario, allowing employees to forecast their pay efficiently. By understanding its functionality and benefits, you can plan your finances better and maximize your take-home pay.

The Starbucks paycheck calculator is more than a simple number-crunching tool. It takes into account hourly wages, overtime, deductions, taxes, and other variables to provide an accurate estimate of your earnings. This tool can help you make informed decisions about your work hours and budgeting, ensuring you get the most out of your time at Starbucks. Whether you are a part-time barista or a full-time shift supervisor, understanding your paycheck can empower you to make smarter financial choices.

Understanding How the Starbucks Paycheck Calculator Works

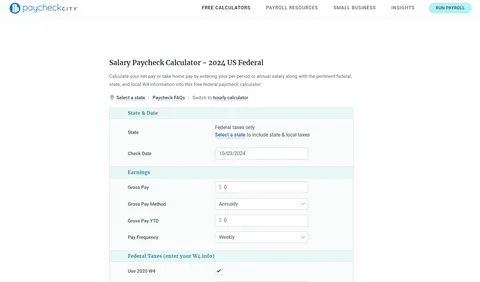

The Starbucks paycheck calculator is designed to simplify the complex process of calculating your wages. At its core, it uses the basic information you provide, such as your hourly rate, weekly hours, and overtime, and applies tax rules and deductions to estimate your net earnings. This means that instead of guessing or manually calculating your pay, you can input your data and get an instant, accurate result. The calculator can also accommodate additional income components, like bonuses or tips, giving you a full picture of your paycheck.

Moreover, the calculator helps employees understand the impact of federal and state taxes, social security contributions, and other mandatory deductions on their earnings. For many Starbucks employees, who may have fluctuating schedules and multiple pay components, this clarity is essential. Using the Starbucks paycheck calculator regularly can prevent surprises when payday arrives and help you track how adjustments in hours or roles affect your overall earnings.

Benefits of Using the Starbucks Paycheck Calculator

One of the primary benefits of the Starbucks paycheck calculator is financial transparency. By knowing exactly how much you will earn before payday, you can budget effectively, plan for expenses, and avoid financial stress. Many Starbucks employees work part-time or manage multiple jobs, making it difficult to track income consistently. With the calculator, you can see the real impact of additional shifts or overtime on your take-home pay, helping you make strategic decisions about your schedule.

Another advantage is empowerment. The Starbucks paycheck calculator allows employees to explore “what-if” scenarios, such as the effect of working extra hours or switching shifts. It also helps you identify areas where you may be overpaying taxes or missing deductions that could improve your net income. Essentially, this tool transforms financial management from a guessing game into an informed process, ensuring you maximize your earnings potential at Starbucks.

Tips for Maximizing Earnings with the Starbucks Paycheck Calculator

To truly benefit from the Starbucks paycheck calculator, it’s important to use it strategically. First, ensure that all the data you input is accurate, including your hourly rate, expected hours, and any bonuses or tips. This will give you the most reliable estimate of your paycheck. Accurate input also allows you to experiment with different schedules, helping you determine the most profitable work plan for your lifestyle and goals.

Another tip is to use the calculator to forecast seasonal changes in your earnings. For instance, Starbucks employees often experience fluctuations in shifts during holidays or promotional periods. By inputting projected hours into the Starbucks paycheck calculator, you can see how your income might vary and plan your spending or savings accordingly. This foresight ensures that you are not caught off guard and allows you to make proactive adjustments to maximize your earnings.

Common Mistakes to Avoid When Using the Starbucks Paycheck Calculator

While the Starbucks paycheck calculator is incredibly useful, mistakes in data entry or assumptions can lead to inaccurate results. A common error is not including overtime or tips, which can significantly affect your net pay. Always account for all sources of income and additional hours to get a true reflection of your earnings. Neglecting these elements can give you a false sense of your financial situation and undermine your planning efforts.

Another mistake is forgetting about tax adjustments or deductions specific to your location. Taxes vary by state, and the Starbucks paycheck calculator can only provide accurate results if it accounts for local rules. Additionally, some employees may have voluntary deductions, like retirement contributions or health insurance, which must also be included. Double-checking all these variables ensures that your paycheck estimate is precise and reliable, allowing you to make informed decisions about your finances.

Making the Most of Your Starbucks Paycheck

Once you understand how to use the Starbucks paycheck calculator effectively, you can start applying its insights to maximize your earnings. One approach is to plan your schedule strategically, focusing on peak hours or days that offer more shifts and higher pay. Additionally, tracking your paycheck over time using the calculator helps identify trends, such as which roles or shifts provide the best return for your effort. This knowledge empowers you to work smarter, not just harder, and optimize your income consistently.

Another way to leverage the calculator is to combine it with personal budgeting tools. By knowing exactly how much you will earn, you can allocate funds to savings, bills, and discretionary spending efficiently. The Starbucks paycheck calculator becomes a key component of your financial toolkit, helping you not just understand your paycheck but also use it to achieve your broader financial goals. Over time, this strategic approach can significantly enhance your financial stability and growth while working at Starbucks.

Conclusion

The Starbucks paycheck calculator is an essential tool for any Starbucks employee seeking clarity and control over their earnings. By providing accurate estimates of your pay, accounting for taxes, overtime, and tips, it transforms how you plan and manage your finances. Beyond simple calculations, it empowers employees to make strategic decisions, optimize schedules, and forecast income fluctuations.

Using the Starbucks paycheck calculator regularly allows for better financial planning, maximized earnings, and reduced stress about payday surprises. By understanding how to use it effectively and avoiding common mistakes, you can ensure that your hard work is rewarded fairly and efficiently. Whether for budgeting, savings, or planning extra shifts, this tool is indispensable for anyone aiming to maximize their earnings at Starbucks.